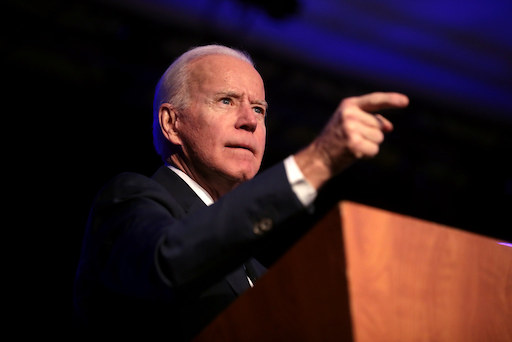

A federal court in Texas slapped down President Joe Biden’s student loan forgiveness programme Thursday, finding it unlawful. Student loan borrowers are now waiting forever to know if they’ll receive debt relief.

The DOJ quickly appealed to the 5th Circuit. This matter must be resolved before the Biden administration can discharge student loans.

The Biden administration has faced three court challenges to the student loan forgiveness programme since August. Thursday’s verdict is the most serious defeat so far, causing the Department of Education to suspend accepting debt relief applications.

Biden’s programme was on pause owing to a different court challenge, but the administration continued receiving applicants.

Low- and middle-income borrowers can get up to $10,000 in federal loan forgiveness and up to $20,000 if they also got a Pell award.

The legal path forward is uncertain, and resolution might take months.

The Texas ruling “makes it more probable that the matter will get to the Supreme Court,” said National Consumer Law Center attorney Abby Shafroth.

How about borrowers?

Borrowers must wait for the government’s 5th Circuit appeal. Borrowers can subscribe to Department of Education alerts and visit the Federal Student Aid website for further information.

A final verdict might take months. If it overturns the Texas judgement, Biden might eliminate student debt.

The DOJ might potentially request an emergency stay of the judge’s order. If approved and a separate appeals court lifts its temporary hold on the programme, the government could eliminate debt before the 5th Circuit rules.

finish

The Biden administration first claimed it would cancel student loans until pandemic-related payments restart in January.

Thursday’s Texas verdict threatens that schedule.

“For the 26 million borrowers who have already given the Department of Education the necessary information for debt relief – 16 million of whom have already been approved for relief – the Department will hold onto their information so it can quickly process their relief once we prevail in court,” said White House press secretary Karine Jean-Pierre on Thursday.

We disagree with the District Court’s student debt relief programme finding, she stated.

Legal arguments?

The Biden administration argues that Congress gave the secretary of education the ability to discharge student loan debt under the 2003 HEROES Act.

Government attorneys say the legislation authorises the secretary to cancel debt in a national emergency, like the Covid-19 outbreak.

The Texas federal judge determined that the statute does not clearly authorise the executive branch to implement the student loan forgiveness programme.

The programme is an illegal exercise of Congress’ legislative power, wrote Trump nominee Judge Mark Pittman.

“In our nation, we’re not dominated by a pen-and-phone CEO,” he said.

The Job Creators Network Foundation filed the Texas case on behalf of two debtors who did not qualify for debt relief.

One plaintiff doesn’t qualified for student loan forgiveness since her debts aren’t federally owned, while the other is only eligible for $10,000 in debt relief because he didn’t earn a Pell award.

They contended they couldn’t disagree with the program’s regulations since the administration didn’t follow the Administrative Procedure Act’s notice-and-comment rulemaking procedure.

Elaine Parker, president of Job Creators Network Foundation, said Thursday that the verdict preserves the rule of law, which compels all Americans to have their opinions heard by the federal government.

Bernie Marcus, a Trump contributor and Home Depot CEO, created the lobbying group.

Where are additional cases?

The Biden administration faces many challenges over the student debt forgiveness programme.

The 8th US Circuit Court of Appeals is considering a challenge from six Republican-led states. On October 21, an appeals court put a stay on the scheme, blocking debt cancellation.

The states say the Biden administration lacks the legal power to provide extensive student loan forgiveness and that the proposal will affect them financially. Lower court said states lacked legal standing to suit. States appealed to 8th Circuit.

The Biden administration has won three court cases so far because petitioners lack standing.

A trial-level federal court rejected a Wisconsin taxpayers group’s case for lack of standing. Plaintiffs said the $400 billion debt forgiveness programme will damage taxpayers and the Treasury. Supreme Court Justice Amy Coney Barrett also declined to intervene.

Separately, Barrett and a lower court rejected a borrower’s claim that debt forgiveness would increase his state tax obligation. Some states tax debt forgiveness, but the feds don’t.

The Biden administration faces challenges from Arizona’s Republican Attorney General Mark Brnovich and the libertarian Cato Institute. Both cases contend that the president cannot eliminate student loan debt.

Brnovich says Arizona has standing to sue since the programme might diminish tax revenue. State law doesn’t tax debt forgiveness.

The Arizona complaint also claims the forgiving policy would damage the AG’s ability to recruit. Some potential job candidates may not perceive Public Service Loan Forgiveness as an advantage if their student loan debt is already erased, the complaint says.

The Cato Institute says the programme makes it difficult to hire.

Who may get loan forgiveness?

Individual borrowers who earned less than $125,000 in 2020 or 2021 and married couples or heads of households who earned less than $250,000 might have up to $10,000 of federal student loan debt cancelled.

If a borrower obtained a Pell award while in college, up to $20,000 in debt can be erased.

Not all federal student loans can be forgiven. Eligible loans include subsidised, unsubsidized, parent PLUS, and graduate PLUS.

Guaranteed federal student loans held by private lenders are ineligible unless the borrower qualified for a Direct Loan before September 29.