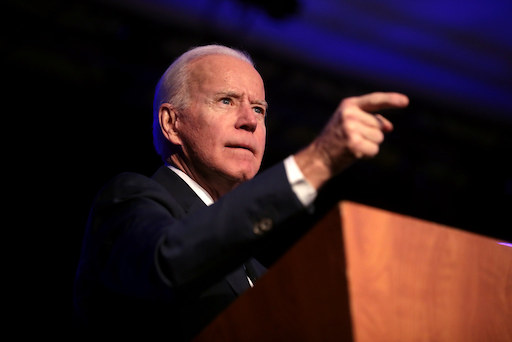

Borrowers may now submit an application for student loan forgiveness through the Biden administration’s beta program. But there are a few things you need to be aware of first.

Where to Find the Application for Student Loan Forgiveness

For Biden’s new student loan forgiveness program, which can offer up to $20,000 in loan forgiveness for federal student loans handled by the government, the Education Department has made an online application available.

You can access the application here on the StudentAid.gov website. Borrowers are not required to use their FSA ID, which serves as their personal username and password, to sign in to the StudentAid.gov website. Simply complete the online form, sign it digitally, and submit it.

Borrowers have been cautioned by the Education Department about con artists. You don’t need to go through a third party company to apply; you may do it straight through this official online application page.

The Procedure for Requesting Student Loan Forgiveness

Simply put, borrowers must submit their information (name, contact details, and personal identifying information like their Social Security number and date of birth). To be eligible for student loan forgiveness under Biden’s plan, individuals must additionally certify under penalty of perjury that they made less than $125,000 (or less than $250,000 if they are married) in income in either 2020 or 2021. The Education Department’s website has more information on the requirements for the one-time student loan forgiveness effort.

An electronic confirmation of submission should be sent to borrowers for your records.

Borrowers won’t need to include any supporting materials with their applications. To confirm income statistics, the Education Department will thereafter follow up with several million borrowers over the course of the following year or longer. If you get a request like that, you should be ready to give a copy of your tax return.

What a Student Loan Forgiveness Application’s “Beta Launch” Means

The application for student loan forgiveness has now gone into beta testing. This indicates that before making the program more widely accessible, the Education Department is using this initial launch to test the workflow and make adjustments. You will not receive immediate relief even though the Education Department claims that your application will be handled and you won’t need to submit it again.

Additionally, if there is a lot of traffic, the beta application may briefly stop working. Last night, some users had already reported issues. And as at the time of writing, the app is in fact momentarily unavailable.

The webpage for the application welcomes visitors with the words “Thanks for visiting the Student Loan Debt Relief Application.” “In order to prepare for our official launch, we’re allowing occasional access to the form. Thank you for your interest in debt relief, and please come back soon.

No processing of requests for student loan forgiveness But Not Yet

Although the application is valid, no request for student loan forgiveness will be handled right away. The government stated in a court filing earlier this month that any request will be processed and authorized no early than October 23.

The Education Department has previously stated that applicants should anticipate a four- to six-week processing time for their applications.

Coming Soon: Full Application Launch

Don’t worry if you can’t access the beta application; you still have until December 31, 2023, to do so. Although the Education Department has not given a specific date for when the larger application will be available, it should happen later this month.

Of course, the initiative is being challenged in a number of court cases. The program might be postponed or stopped depending on the results of preliminary hearings in these lawsuits. A preliminary injunction hearing earlier this week would have been a good early test, and the court might decide on one this week.